The Goldman Sachs logo on the floor of the New York Stock Exchange last year For Goldman, it represents the latest move in the Wall Street giant's recent push into private equity Goldman Sachs Asset Management invests in the full spectrum of alternatives, including private equity, growth equity, private credit, real estate and infrastructureGoldman Sachs Loan Partners and Senior Credit Partners benefits from strong relationships with leading private equity sponsors and management teams across the globe Along with the ability to leverage the rest of the Goldman Sachs franchise, these relationships help us generate opportunities to finance companies in need of capital

Goldman Sachs Introduction Pdf Investment Banking Goldman Sachs

Goldman sachs private equity partners ix

Goldman sachs private equity partners ix- Goldman Sachs is a company that sells mutual funds with $532,966M in assets under management The average expense ratio from all Goldman Sachs mutual funds is 060% 7769% of these mutual funds are no load funds The oldest fund was launched in 19;Goldman Sachs Personal Financial Management is a national wealth management firm that puts clients' needs first & provides financial advisors with all the tools they need to help their clients succeed Find Out More

Goldman Sachs By Amandeep Gill Geoff Thomasson Katherine

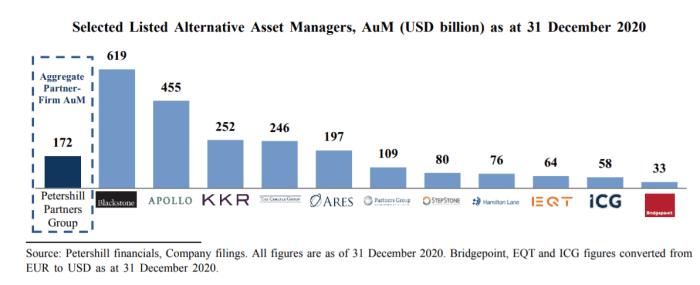

Petershill, which takes minority stakes in private equity and hedge funds, will be a standalone company operated by the Goldman Sachs Asset Management team, it said on Monday The deal would consist of a sale of around $750 million of new shares as well as existing ones to give Petershill a free float of at least 25% and make it eligible to beEquity Execution Services Client Communications Goldmancom (Private Wealth Management) GSAMcom GS Research Portal Liquidity Investing Marcus Marquee Personal Financial Management Transaction Banking About About Goldman Sachs Asset Management Private Equity Bringing together traditional and alternative investments, Goldman Sachs Asset Management provides clients around the world with a dedicated partnership and focus on longterm performance As the primary investing area within Goldman Sachs (NYSE GS), we deliver investment and advisory services

The Goldman Sachs company logo is on the floor of the New York Stock Exchange (NYSE) in New York City, US, REUTERS/Brendan McDermid Summary Go Reuters Sep 6 Goldman lines up $5 billion Petershill private equity asset float FILE PHOTO The Goldman Sachs company logo is on the floor of the NYSE in New York By Lawrence White FILE PHOTO The Goldman Sachs company logo is on the floor of the New York Stock Exchange (NYSE) in New York City, US, REUTERS/Brendan McDermid/File Photo LONDON (Reuters) – Goldman Sachs (NYSE GS ) on Thursday lowered its view of China's offshore equity markets in the wake of a market rout prompted by Beijing's sweeping Goldman Sachs Asset Management is one of the world's leading investment managers Across 33 offices worldwide, we extend these global capabilities to the world's leading pension plans, sovereign wealth funds, central banks, insurance companies, financial institutions, endowments, foundations, individuals and family offices, for whom we invest or advise on more

Goldman Sachs plans to list the assets of Petershill Partners, cashing in on a private equity boom with a deal which could value the investment vehicle at more than $5 billion Petershill, which takes minority stakes in alternative assets managers including private equity and hedge funds, will be a standalone company operated by the Goldman Sachs Asset Management Kerryann Benjamin joins the privateequity giant from Goldman Sachs, where she spent two decades Benjamin, who will be based in New York, will report to Sandra Ozola, global head of human capital Aerospace & Defense CBHDT Holdings, Inc (dba Hunter Defense Technologies) Common Stock Aerospace & Defense CFS Management, LLC (dba Center for Sight Management) 1st Lien/Senior Secured Debt Health Care Providers & Services Chase Industries, Inc (dba Senneca Holdings) 2nd Lien/Senior Secured Debt

Goldman Sachs Asset Management Homepage

Parexel To Be Acquired By Eqt Private Equity And Goldma

Goldman Sachs 2,813,442 followers on LinkedIn At Goldman Sachs, we believe progress is everyone's business That's why we commit our people, capital and ideas to help our clients The logo for Goldman Sachs appears above a trading post on the floor of the New York Stock Exchange Photo AP Goldman Sachs is finally embracing its status as a private equity Goldman Sachs and its private equity division is heavily invested in technology, financing, and retail providers Discover the company's notable investments

Goldman Sachs Leans Heavily On Private Equity As Volcker Looms Thestreet

Parexel To Be Acquired By Eqt Private Equity And Goldman Sachs Asset Management Be Korea Savvy

Goldman Sachs Asset Management invests in the full spectrum of alternatives, including private equity, growth equity, private credit, real estate and infrastructure Established in 1986, the Private Equity business within Goldman Sachs Asset Management has invested over $75 billion since inception The new fund, substantially smaller than Goldman's biggest fund of $ billion in 07, underscored its commitment to the private equity business Goldman Sachs Group Inc plans to raise $8 billion in only its second buyout fund since the 08 financial crisis, bolstering its ability to secure deals worldwide, said two people with direct Goldman Sachs plans to float the assets of its Petershill Partners unit, hoping to cash in on a private equity boom with an IPO valuing the investment vehicle at more than $5 billion Petershill, which takes minority stakes in alternative assets managers including private equity, venture capital and hedge funds, will be a standalone company operated by the Goldman Sachs

Goldman Sachs Introduction Pdf Investment Banking Goldman Sachs

Goldman Plans To Raise About 2 Billion For A New Venture Fund Private Equity Insights

Goldman Sachs is gearing up for M&A activity to continue through the second half of 21, global M&A coheads Stephan Feldgoise and Mark Sorrell said Privateequity buyers have been a keyThe Goldman Sachs company logo is on the floor of the New York Stock Exchange (NYSE) in New York City, US, REUTERS/Brendan McDermid Summary Go Reuters Sep 6 Goldman lines up $5 billion Petershill private equity asset float FILE PHOTO The Goldman Sachs company logo is on the floor of the NYSE in New York By Lawrence White The Goldman Sachs Group Inc general counsel Karen Seymour received more than $9 million in total compensation last year, a slight increase over what she earned in 19 David Solomon, chairman and CEO of Goldman, announced earlier this month that Seymour had chosen to retire March 31 and return to Sullivan & Cromwell in New York, where she had

Kkr Appoints Goldman Sachs Veteran Kerryann Benjamin To Lead Diversity

Lei Of Goldman Sachs Private Equity Group Master Fund V Llc United States Of America Lei Info

Goldman Sachs Short Dur Govt Instl (GSTGX) DPH 133% Goldman Sachs on Monday said it was going to list its alternative asset management unit on the London Stock Exchange Petershill Partners buys up minority stakes in privateequity Goldman Sachs is preparing to list a new investment vehicle, Petershill Partners, on the London Stock Exchange in a move that could value the unit at £36bn thanks to a boom in the private equity

Goldman Sachs By Amandeep Gill Geoff Thomasson Katherine

How To Move From Banking To Private Equity By A Former Associate At Goldman Sachs Efinancialcareers

Goldman Sachs and CDPQ will be replacing Calera Capital, a private equity firm based in San Francisco and Boston Terms of the transaction were not disclosed Clare Hart, CEO of SterlingBackcheck, commented, "This investment represents an inflection point for SterlingBackcheck Goldman Sachs has particular expertise helping growth companies Goldman lines up $5 billion Petershill private equity asset float FILE PHOTO The Goldman Sachs company logo is on the floor of the New York Stock Exchange (NYSE) in New York City, US, July 13LONDON (Reuters) Goldman Sachs plans to float the assets of its Petershill Partners unit, hoping to cash in on a private equity boom with an IPO valuing the investment vehicle at more than $5

Goldman Sachs Zeros In On Midmarket Esg Infrastructure Deals The Korea Economic Daily Global Edition

Goldman Sachs Private Equity Firm To Buy Happycall

Goldman sachs, goldman sucks, anti banksters, banksters, global elite, banking elite, stop the bankers, end the fed, financial crisis, money is debt, anti goldman sachs, feed the poor, resist, power to the people, illuminati anti Goldman Sachs Goldman SUCKS anti banksters and global elite Tall Mug By 1984Store David Solomon, CEO of Goldman Sachs REUTERS/Lucy Nicholson Summary List Placement This year's surge in M&A likely won't die down any time soon, according to top Goldman dealmakers Goldman's M&A advisory revenues have already hit record highs this year While Goldman said in secondquarter earnings that its investmentbanking backlog also ended theGoldman Sachs Shop Goldman Sachs clothing on Redbubble in confidence Tshirts, hoodies, tops, dresses, skirts, hats, and more in a huge range of styles, colors, and sizes (XS plus size) Whether you wear women's clothing or men's clothing you'll find the original artwork that's perfect for you Every purchase supports the independent

Goldman Sach S Private Equity Arm Sold Safe Guard Products International Private Equity Insights

Goldman Sachs Gs Growth

The Goldman Sachs company logo on the floor of the NYSE in New York Photograph Brendan McDermid/Reuters Goldman Sachs is preparing to list a new investment vehicle, Petershill Partners, on the London Stock Exchange in a move that could value the unit at £36bn thanks to a boom in the private equity marketGoldman Sachs Raises $103 Billion to Acquire Buyout Stakes (Bloomberg) Goldman Sachs Group Inc raised $103 billion for a new fund that will primarily buy private equity stakes as Goldman Sachs Private Wealth Management has 1,366 employees, 6 of whom provide wealth advisory functions Goldman Sachs has won numerous awards, including for its private banking and wealth management services The company has also won awards related to diversity, including for its policies for working mothers and LGBT inclusivity

Goldman S Rich Friedman Steps Down As Head Of Merchant Bank

Goldman Sachs Funds To Acquire A Majority Stake In Advania

Goldman Sachs and Jefferies LLC acted as financial advisors to EQT Private Equity and Goldman Sachs Asset Management, and Simpson Thacher & Bartlett LLP provided legal counsel in connection with Equity Screener Equity Screener The Goldman Sachs company logo is on the floor of the NYSE in New York At a time when private capital is finally pouring into climate innovation, Fancy Goldman Sachs is preparing to list a new investment vehicle, Petershill Partners, on the London Stock Exchange in a move that could value the unit at £36bn thanks to a boom in the private equity market Petershill Partners is expected to raise about $750m (£542m) through an initial public offering (IPO) that will give institutional investors such as pension funds a chance to

Episode 5 Private Equity Billionaire S Path From Goldman Sachs Private Equity Show Lyssna Har Poddtoppen Se

Goldman Sachs Logo Goldman Sachs Design

Pooja Goyal is a Partner and CoHead of the Infrastructure Group, CoHead of the Carlyle Global Infrastructure Opportunity Fund (CGI), and Head of Renewable and Sustainable Energy She is based in New York Prior to joining Carlyle, Ms Goyal was the Head of the Alternative Energy Investing Group at Goldman Sachs, where she led Goldman Sachs Goldman Targets $5 Billion Float for Petershill Private Equity Assets More FILE PHOTO The Goldman Sachs company logo is on the floor of the New York Stock Exchange (NYSE) in New York City, US BOCA RATON, Fla, /PRNewswire/ MDVIP, the national leader in personalized membershipbased healthcare, today announced that the Private Equity business within Goldman Sachs Asset

Goldman Sachs Private Equity Emerges Frontrunner To Acquire Chryscap Stake In Gvk Biosciences

Gscp Goldman Sachs Capital Partners Private Equity Division By Acronymsandslang Com

LONDON (Reuters) – Goldman Sachs (NYSE) plans to float the assets of its Petershill Partners unit, hoping to cash in on a private equity boom with an IPO valuing the investment vehicle at more than $5 billionGoldman Sachs Capital Partners is the private equity arm of Goldman Sachs that invests on behalf of institutional clients It has invested over $17 billion in the years from 1986 to 06 One of the most prominent funds is the GS Capital Partners VGoldman Sachs Capital Partners is the private equity arm of Goldman Sachs, focused on leveraged buyout and growth capital investments globally The group, which is based in New York City, was founded in 1986As of 19, GS Capital Partners had raised approximately $399 billion since inception across seven funds and has invested over $17 billion

Goldman Unveils Blackstone Like Investments Group Financial Times

Goldman Sachs Private Equity Firm Cook Up Deal For Korean Kitchenware Maker Wsj

The Goldman Sachs company logo on the floor of the NYSE in New York Photograph Brendan McDermid/Reuters Goldman Sachs is preparing to list a new investment vehicle, Petershill Partners, on the London Stock Exchange in a move that could value the unit at £36bn thanks to a boom in the private equity market Petershill Partners is expected to raise Goldman Sachs will contribute a 1 billion euro syndicated ($117 billion) loan to private equity firm CVC's planned 27 bln euro investment inIn Jun97, The Goldman Sachs Group, Inc acquired the assets and business of Commodities Corporation Limited, a Princeton New Jerseybased asset management firm established in 1969 specializing in alternative investments, and contributed them to a newly formed wholly owned subsidiary, Commodities Corporation LLC, which was renamed Goldman Sachs

Amd Gsam Aims Private Equity Vice President San Francisco San Francisco Ca Goldman Sachs

Goldman Sachs S Petershill Plans London Listing Wsj

The typical Goldman Sachs Private Equity Analyst salary is $85,000 per year Private Equity Analyst salaries at Goldman Sachs can range from $65,276 $150,026 per year This estimate is based upon 6 Goldman Sachs Private Equity Analyst salary report (s) provided by employees or estimated based upon statistical methods FILE PHOTO The Goldman Sachs company logo is on the floor of the NYSE in New York LONDON (Reuters) – Goldman Sachs unit Petershill Partners plans to raise at least $750 million in London by

Goldman Sachs Private Equity Arm Explores Sale Of Hearthside Food Solutions Llc 18 01 25 Snack And Bakery

Goldman Sachs Picks London For Private Equity Ipo As Ftse Climbs After U S Jobs Data Marketwatch

Goldman Raises 10 3b For Fund To Snap Up Private Equity Stakes Report

3

Goldman S Private Equity Problem Is Getting Bigger Fortune

Goldman Sachs Sets Aside Billions To Invest In Private Equity Firms New York Business Journal

Goldman Sachs Annual Report

Parexel Acquired By Eqt Private Equity And Goldman Sachs Asset Management Health News Et Health World India News Republic

5rdc0cufchtlmm

Goldman Sachs Sanjeev Mehra To Retire After Nearly 30 Years With Wall Street Firm

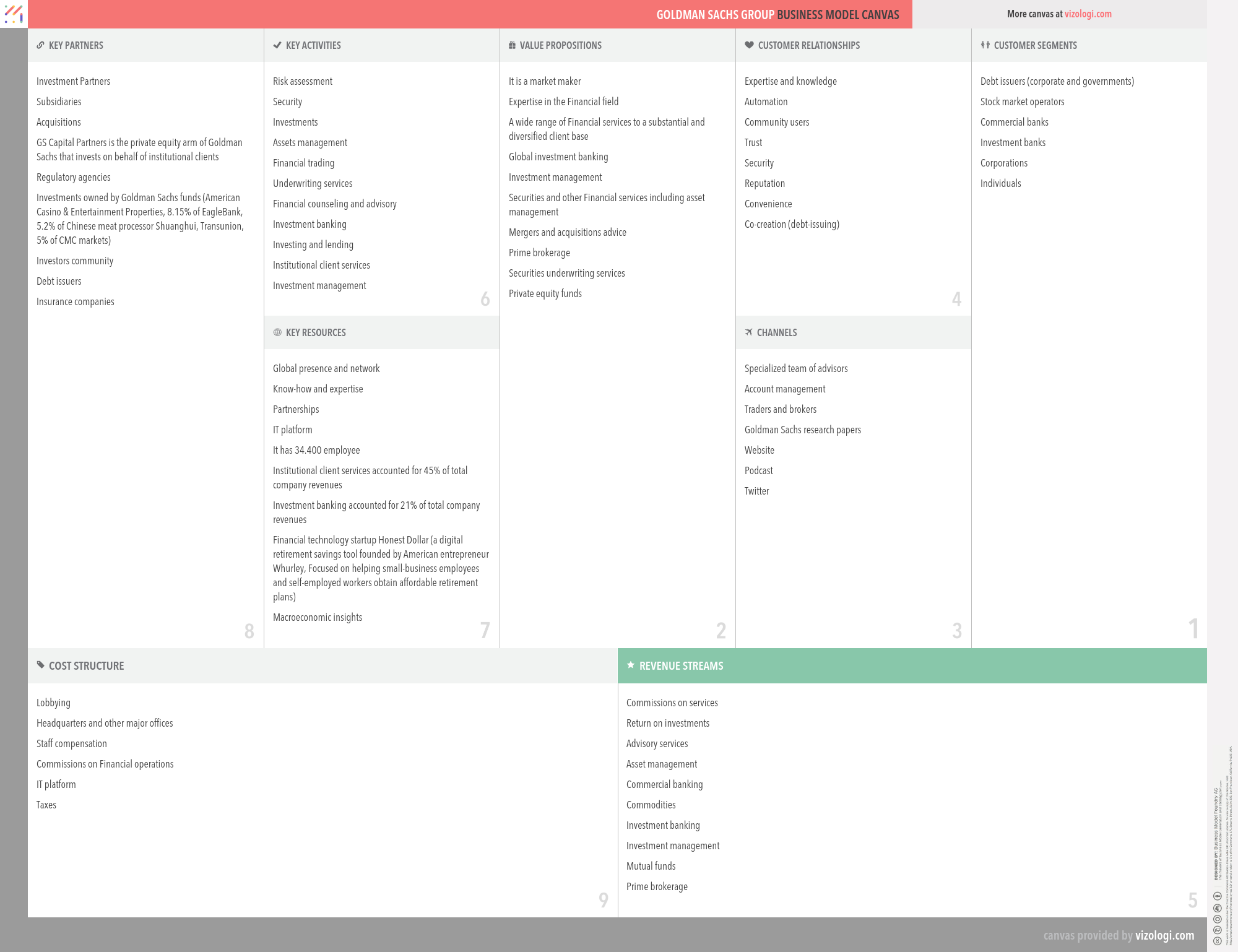

What Is Goldman Sachs Group S Business Model Goldman Sachs Group Business Model Canvas Explained Vizologi

Goldman Sachs Mints Billions Through Business It Is Looking To Shrink Financial Times

Goldman Sachs S Petershill Plans London Listing Global Online Money

Goldman Sachs Leads Globaldata S Top Global M A Financial Adviser League Table For Fy18 Globaldata

How Youssef Kabbaj Can Help You With Best Outcomes For Private Equity

Goldman Sachs Renewable Power Climate Bonds Initiative

Goldman Lines Up 5bn Petershill Private Equity Asset Float Private Equity Insights

Private Equity Billionaire S Path From Goldman Sachs Youtube

Goldman Sachs Private Equity Banker Zaimoglu To Leave Bnn Bloomberg

Goldman Sachs Private Equity Partners 04 Offshore Lp

Goldman Sachs Blows Past Earnings Estimates Barron S

Goldman Sachs Taps Public Markets To Bet On Private Equity Newsaroundworld Org

Goldman Sachs Insights Exchanges At Goldman Sachs

Private Equity Jobs Of The Week Omers Goldman Sachs And Ubs Are Hiring Pe Hub

Goldman Lines Up 5 Billion Petershill Private Equity Asset Float

Goldman Sachs Raises New Private Equity Fund

Goldman Sachs Alternatives

Goldman Sachs Insights Covid 19

Goldman Sachs Capital Partners 978 613 0 9

Goldman Sachs Archives The Evolution Of Private Equity

Goldman Sachs On The Shift To Low Carbon Technologies Private Equity International

Goldman Sachs 19 Annual Report

Develop The Investor S Mindset Adi Centerbridge Private Equity Goldman Sachs Investment Banking Youtube

Goldman Sachs Risk Management November 17 10 Presented

Goldman Sachs And Citi Make Million Venture Bet That Private Equity Wants Consumers Credit Card Info Live Index

Goldman Sachs Home Facebook

Goldman Sachs First Year Analysts Face 100 Hour Weeks Abusive Behavior Stress Survey Says

Goldman Sachs Needs This Ipo To Go Extremely Well The Washington Post

Goldman Sachs Picks London For Private Equity Ipo As Ftse Climbs After U S Jobs Data Idman News

Goldman Sachs Releases Report On Private Equity Dailyalts

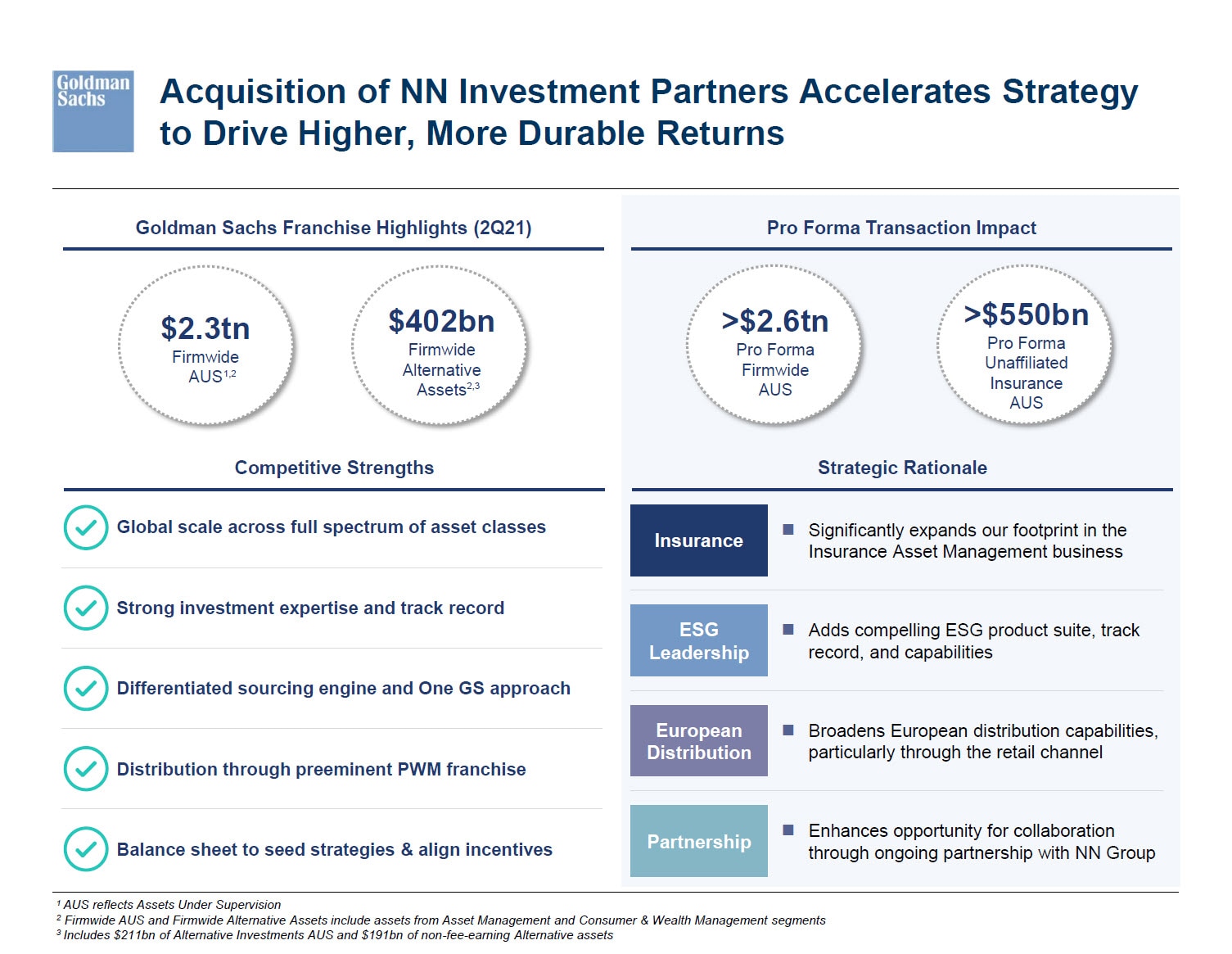

Goldman Sachs To Acquire Nn Investment Partners

Goldman Sachs Has Finalized Its Middle Market Private Equity Team

Goldman Sachs 18 Annual Report

Goldman Sachs Logo

Goldman Sachs Insights Goldman Sachs Research

Goldman Targets Us 5bil Float For Petershill Private Equity Assets The Star

David Solomon Explains Goldman Private Equity Strategy Shift

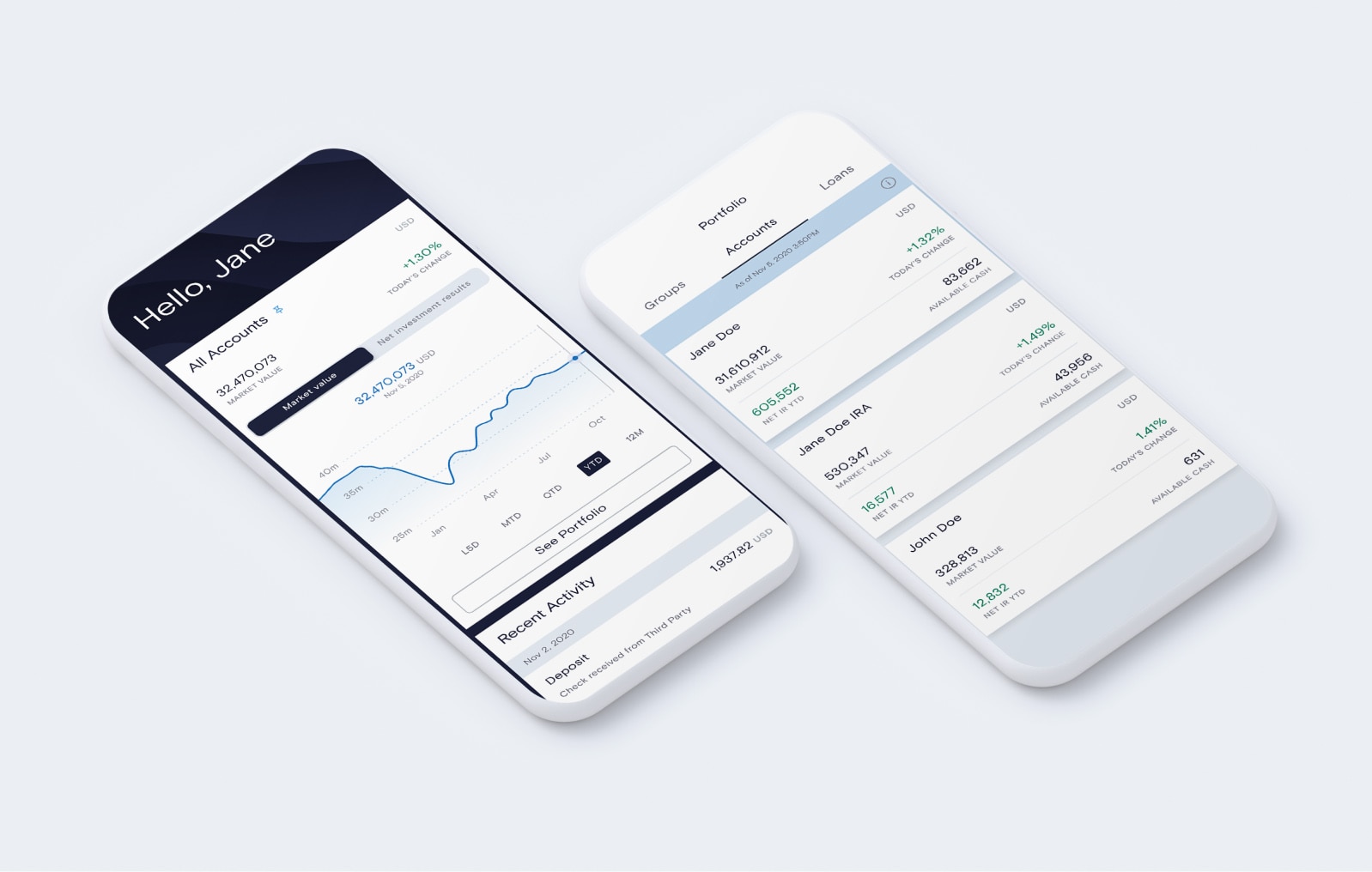

Goldman Sachs Private Wealth Management Mobile Access For Our Private Clients

Goldman Sachs Group

Goldman Sachs Says That Every One Of Its Private Equity Clients Is Preparing For Recession Markets Insider

Goldman Sachs Is Raising Up To 8 Billion For New Private Equity Fund Fortune

Goldman Sachs Plans Ipo For 5bn Petershill Partners Financial Times

Goldman Sachs Capital Partners Wikipedia

Goldman S Petershill Unit Plans 5bn Alternative Assets Listing In London Financial News

Goldman Sachs Merchant Banking Division Koch Positions Adds Matthias Hieber Head Of Corporate Equity Investing In

Sciences Po Carrieres

Goldman Sachs Raising 5 Billion 8 Billion Private Equity Fund Wsj

Goldman Sachs

Goldman Sachs Insights Exchanges At Goldman Sachs

Goldman Sachs Private Equity Arm Sold Safe Guard Products International Barron S

Goldman Sachs Names New Leaders To Handle Equity Investments

Youssef Kabbaj Goldman Sachs Former Strategist For Consulting On Trade And Technology By Youssefkabbaj Issuu

Goldman Sachs Press Releases Goldman Sachs Announces Acquisition Of United Capital

Goldman Sachs Forms In House Group To Spot Out Of The Box Deals For Big Firms Vccircle

Goldman Private Equity Push Takes A Hit Wsj

A 2b Goldman Sachs Venture Fund Could Be Very Good News For Fintechs Finledger

Goldman Sachs Asset Management And Charlesbank Capital Partners To Acquire Majority Ownership Of Mdvip From Leonard Green Partners And Summit Partners Citybiz

Infostretch Announces Private Equity Investment From Goldman Sachs Merchant Banking Division And Everstone Group

Eqt Group V Twitter Eqt Private Equity And Goldman Sachs Asset Management To Acquire Parexel A Leading Global Clinical Research Organization For Usd 8 5 Billion Read More T Co Crzwugdkgf T Co Fhqjd3ec9a

Stream Scale Sophistication And Global Relevance Asia S Private Equity Market By Goldman Sachs Listen Online For Free On Soundcloud

Private Equity Recruitment Michael Hellman Friedman Private Equity And Goldman Sachs Ibd Youtube

The Active Private Equity Landscape In Europe

Goldman Sachs Sends Staff Home After Two Covid 19 Cases On Trading Floors Private Equity News

Declined Goldman Sachs For Singapore S Private Equity Fund London News Time

1

Goldman Sachs Wikipedia

Investment From Goldman Sachs Den Networks

Gs Growth Crunchbase Investor Profile Investments

Goldman Sachs 18 Annual Report

Insurers Favour Private Equity Over Hedge Funds Goldman Sachs Survey Vccircle

0 件のコメント:

コメントを投稿